Legal Challenges To The Tax Proposal On Unrealized Gains: A Complex Path Ahead

The recent tax proposal targeting the unrealized gains of America’s wealthiest individuals has sparked significant debate and concern, particularly among the ultra-rich in sectors like Silicon Valley. The plan, designed to address the growing wealth inequality in the United States, proposes taxing the increase in value of assets such as stocks before they are sold. While the initiative has garnered support from those advocating for a fairer tax system, it faces numerous legal challenges that could complicate its implementation.

Constitutional Concerns and the Definition of Income

At the heart of the legal debate is the question of constitutionality under the 16th Amendment, which grants Congress the power to levy taxes on income. The critical issue is whether unrealized gains—an increase in asset value that has not been converted into cash through a sale—can be considered "income" under the law. Traditionally, income is defined as realized gains, meaning wealth that has been actually received by the taxpayer. Critics argue that taxing unrealized gains stretches the definition of income beyond its legal limits, potentially making the proposal unconstitutional. This challenge is likely to be a focal point in any legal battles that may arise if the tax is enacted.

Administrative Complexity and Practical Challenges

Another significant hurdle is the practical difficulty of assessing and taxing unrealized gains, particularly for privately held investments and illiquid assets. Unlike publicly traded stocks, which have easily accessible market values, the valuation of assets like real estate, privately held businesses, or artwork is much more complex and subjective. This could lead to administrative burdens on both the IRS and taxpayers, opening the door to legal challenges based on the impracticality and potential arbitrariness of the assessments.

Equal Protection and Targeted Taxation

The proposal's focus on the ultra-wealthy—initially targeting billionaires and later expanding to individuals with assets exceeding $100 million—raises concerns about equal protection under the law. Opponents argue that singling out a specific group of taxpayers for a new tax regime could be seen as discriminatory. This could potentially lead to challenges based on the Equal Protection Clause of the Constitution, which mandates that individuals in similar situations be treated equally under the law.

Retroactivity and Fairness Issues

If the tax is applied to past unrealized gains, it could face significant opposition on the grounds of retroactive taxation. Retroactivity is generally disfavored in tax law because it imposes a tax burden based on decisions made under a different tax regime, potentially violating principles of fairness and predictability. Taxpayers could argue that applying the tax to past gains would be unjust and could lead to legal challenges aimed at preventing retroactive application.

International Conflicts and Investor-State Disputes

The global nature of wealth, particularly among the ultra-rich, introduces additional legal complexities. The proposal could conflict with existing international tax treaties, leading to disputes with other countries or multinational corporations. Moreover, the tax could trigger investor-state dispute settlement (ISDS) cases under international investment agreements. These agreements often protect investors from discriminatory or unfair treatment by foreign governments, and a new tax on unrealized gains could be viewed as a violation, leading to costly and prolonged legal battles in international courts.

Recent Supreme Court Rulings and Regulatory Challenges

Recent rulings by the U.S. Supreme Court have made it easier to challenge tax regulations under the Administrative Procedure Act. This legal framework requires that government regulations be both reasonable and well-supported by evidence. Opponents of the tax proposal could use these rulings to argue that the new tax regulations are arbitrary, capricious, or not adequately justified, potentially leading to successful challenges that could delay or derail the implementation of the tax.

The tax proposal on unrealized gains represents a bold attempt to address wealth inequality, but it is fraught with legal challenges that could significantly complicate its path to implementation. From constitutional concerns and practical difficulties to international disputes and recent legal precedents, the proposal will likely face substantial scrutiny in the courts. While proponents argue that the tax is necessary to create a fairer system, its legal viability remains uncertain, suggesting that any move towards taxing unrealized gains will be met with fierce resistance both legally and politically.

World Liberty Seeks Federal Trust Charter

World Liberty Financial, the crypto venture backed by the Trump family, has applied for a US national bank trust charter... Read more

Saudi Banks Tap Overseas Markets

Saudi Arabia’s banks are borrowing from international markets at their fastest pace on record, as lenders try to squar... Read more

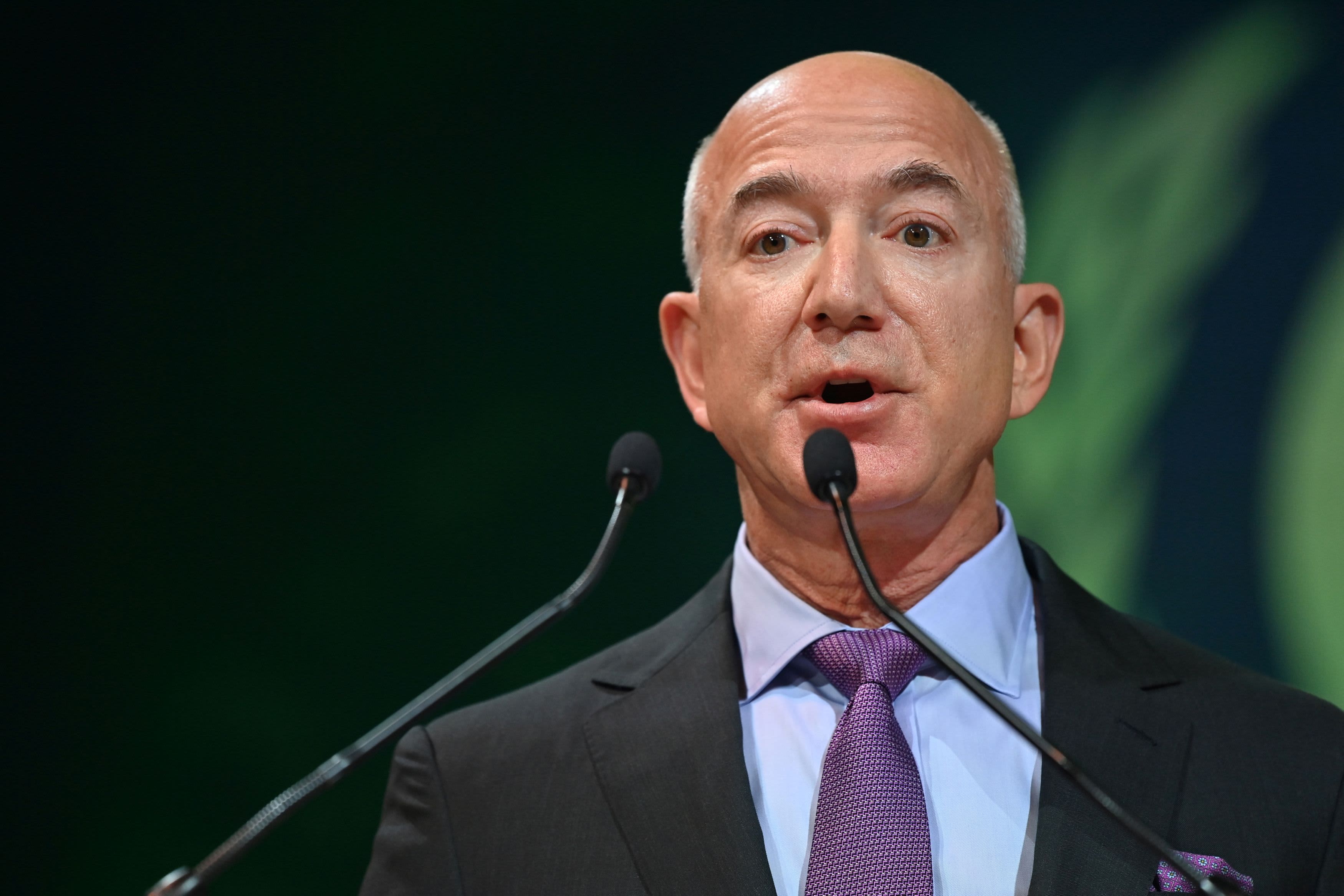

Amazon Continues To Cut 16000 Gone

Amazon has announced plans to cut a further 16,000 roles from its corporate workforce, extending the cost and organisati... Read more

The UK May Have A Voice In Ai

Europe’s AI sector has grown accustomed to playing catch-up. Capital has flowed more slowly than in Silicon Valley, va... Read more

Musk Applies Pressure To BT

Britain’s broadband market has spent the past decade locked in a familiar pattern. Incumbents invested heavily in fibr... Read more

Blackrock Sees EMEA Moving Into Private Assets

BlackRock has warned that investors across Europe, the Middle East and Africa are reshaping portfolios in response to wh... Read more