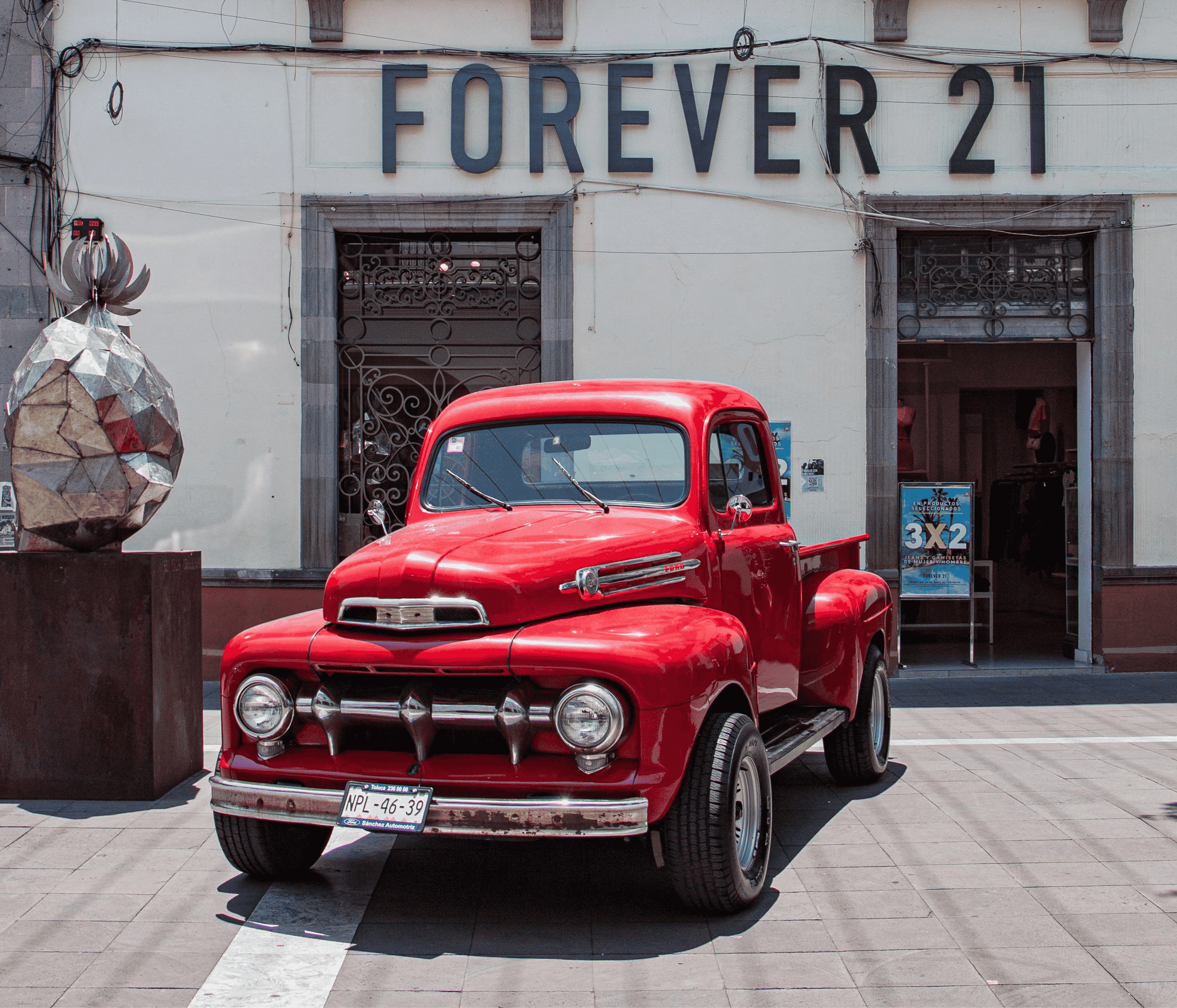

Forever 21: Fashion Giant Falls Again

Forever 21, the iconic American fashion retailer, has filed for bankruptcy protection for the second time in just six years, highlighting the severe pressures facing traditional brick-and-mortar retailers. On 17 March 2025, Forever 21's latest Chapter 11 bankruptcy sent shockwaves across the global retail sector, as the company prepares to shut approximately 350 U.S. stores and liquidate assets under court supervision. Yet, the international business, comprising around 200 licensed stores worldwide, remains unaffected—for now.

Behind the Bankruptcy

The reasons behind Forever 21’s financial troubles reveal deeper problems affecting traditional retail. Firstly, competition has become fierce, especially from online fast-fashion brands like Shein and Temu. These brands have swiftly captured market share with their aggressive pricing strategies and rapid product cycles. Additionally, Forever 21 faced intense competition from e-commerce giant Amazon, further complicating its market position.

A key disadvantage for Forever 21 has been the U.S. "de minimis exemption," which allows foreign companies to ship products valued under $800 to American consumers tax-free. This policy provided a clear price advantage to brands like Shein, eroding Forever 21’s ability to compete on equal footing. As international rivals continue to exploit these regulatory advantages, traditional retailers find themselves increasingly disadvantaged.

Declining foot traffic in U.S. shopping malls—Forever 21's core operational environment—has compounded its woes. Once bustling malls across America now suffer reduced consumer visits, largely due to the convenience and cost-effectiveness of online shopping. This shift in shopping behaviour has drastically impacted traditional retailers dependent on physical store sales, leaving brands like Forever 21 vulnerable.

Operational costs have simultaneously risen, squeezing profit margins further. The cost of running physical stores, including rents, staffing, and logistics, remains high and inflexible compared to lean online operations. Coupled with changing consumer preferences towards sustainability and quality over disposable fashion, Forever 21's business model—built on affordable, fast-changing styles—has struggled to keep pace.

Economic pressures faced by Forever 21’s primary customer base—often younger, price-sensitive consumers—have also undermined sales performance. Rising inflation, cost-of-living pressures, and economic uncertainty have pushed these consumers towards cheaper online alternatives or encouraged them to reduce discretionary spending altogether.

The Rise and Fall of a Retail Icon

Founded in 1984 in Los Angeles by South Korean immigrants, Forever 21 grew rapidly, epitomising the success of fast-fashion retail. At its peak in 2016, the company boasted around 800 stores globally, 500 within the U.S. alone. However, its rapid expansion soon turned into overreach, leaving the retailer highly vulnerable to market disruptions.

The first bankruptcy filing in September 2019 was a significant warning sign. It forced the closure of over 150 U.S. stores, with the remaining assets acquired by Sparc Group. Despite restructuring attempts and the merger of Sparc Group with JC Penney into Catalyst Brands in January 2025, Forever 21 failed to achieve sustained recovery. Persistent market pressures and strategic missteps proved overwhelming, culminating in this second bankruptcy.

The latest bankruptcy proceedings, which formally began on 17 March 2025, will see the brand closing all its U.S. stores starting on 27 May, with liquidation sales expected to conclude by 10 June. Throughout this process, Forever 21’s U.S. stores and its website remain operational, as the company continues its search for potential buyers.

The Future of Forever 21

Despite these challenges, Forever 21 continues to explore opportunities for survival. The retailer is actively seeking buyers interested in acquiring either parts or the entirety of its business. A successful buyer could potentially enable Forever 21 to pivot away from a complete shutdown, possibly maintaining the brand as a going concern.

One significant advantage in Forever 21's favour is its global footprint, specifically the unaffected international operations that span roughly 200 licensed stores outside the U.S. These international locations, operated independently, could form the foundation of a smaller yet sustainable global brand. However, achieving this would require strategic refocusing and potentially abandoning its once-core U.S. market.

Another potential route for Forever 21 is leveraging brand recognition through a transition into an online-only platform. Given the growing dominance of e-commerce, particularly among younger consumers, an agile digital strategy could revitalise the brand, reducing costs and responding directly to evolving consumer preferences.

What’s Next?

Forever 21’s future hinges on its ability to quickly adapt to market realities. The traditional retail model it once dominated is rapidly declining, making adaptation essential. Industry analysts suggest that only brands willing to embrace digital transformation, sustainability, and consumer-driven trends will survive in this new retail landscape.

The coming weeks will be critical as potential buyers consider Forever 21’s assets. If no suitable buyer emerges, we could witness the definitive end of a once-prominent retail giant. Alternatively, a savvy investor might reinvent Forever 21 for a digital-first future, marking a new beginning rather than an end. Regardless of the outcome, Forever 21's bankruptcy signals a clear message: the future of retail belongs to the agile, innovative, and digitally proficient.

World Liberty Seeks Federal Trust Charter

World Liberty Financial, the crypto venture backed by the Trump family, has applied for a US national bank trust charter... Read more

Saudi Banks Tap Overseas Markets

Saudi Arabia’s banks are borrowing from international markets at their fastest pace on record, as lenders try to squar... Read more

Amazon Continues To Cut 16000 Gone

Amazon has announced plans to cut a further 16,000 roles from its corporate workforce, extending the cost and organisati... Read more

The UK May Have A Voice In Ai

Europe’s AI sector has grown accustomed to playing catch-up. Capital has flowed more slowly than in Silicon Valley, va... Read more

Musk Applies Pressure To BT

Britain’s broadband market has spent the past decade locked in a familiar pattern. Incumbents invested heavily in fibr... Read more

Blackrock Sees EMEA Moving Into Private Assets

BlackRock has warned that investors across Europe, the Middle East and Africa are reshaping portfolios in response to wh... Read more