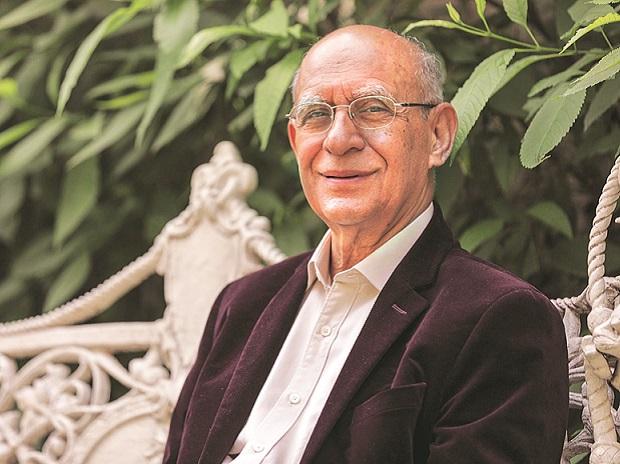

With Happiest Minds, 77-year-old Ashok Soota Hits IPO Jackpot A Second Time

Ashok Soota, a pioneer of India’s information technology services industry, has headed three outsourcing companies including one of the nation’s largest, Wipro Ltd., and taken two of them public.

The second was this week when the initial public offering of his latest startup, Happiest Minds Technologies Ltd., was oversubscribed 151 times. The IPO got bids for 3.51 billion shares versus the 23.3 million on offer, ranking it among India’s most successful first-time share sales of this decade.

“The IPO got a boost from the credibility of the founder,” said Abhimanyu Sofat, head of research at IIFL Securities Ltd. in Mumbai. “That added to investor confidence and led to institutional and foreign investors wanting a piece of the pie.”

Happiest Minds, which gets almost all of its revenue from digital services, is one of two IPOs this week to woo Indian investors. An offering from Route Mobile Ltd., a cloud infrastructure provider, was oversubscribed four times at the end of Thursday as the frenzy for technology stocks globally rubs off on even the smallest of companies.

The huge demand for both the companies bodes well for India’s IPO market, which has seen only two main board offerings in 2020 despite a buoyant stock market. The S&P BSE Sensex is up about 50% from a low in March even as the country saw its worst economic contraction on record in the June quarter and is the new global virus hotspot.

“The oversubscription reflects the premium at which most of the Indian market is priced at,” said Deepak Jasani, head of research at HDFC Securities Ltd. “The Happiest Minds IPO pricing was quite reasonable and left something on the table for investors.”

Digital Focus

The Happiest Minds’ shares were sold in a price range of 165-166 rupees ($2.3) apiece. Soota raised 1.4 billion rupees by selling part of his stake. The sale closed Wednesday and the shares are likely to begin trading next week. Route Mobile’s IPO concludes later Friday.

Soota, 77, founded the Bengaluru-based startup in 2011. The venture followed an acrimonious parting with the co-founders at his previous startup Mindtree Ltd., which he had taken public in March 2007. That IPO was oversubscribed more than 100 times.

Happiest Minds expects to expand at an annualized rate of 20%, almost double the industry growth rate, Soota told BloombergQuint on Sept. 7. The company gets 97% of its revenue from digital services, compared with 30-50% for its local peers, according to a report by Motilal Oswal Securities Ltd.

Soota declined to comment to queries from Bloomberg News, citing compliance requirements.

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more