Tata Sons Amends Articles Of Association At AGM To Split Top Roles

The shareholders of Tata Sons, the holding company of the $128-billion salt-to-software group, on Tuesday cleared a significant amendment to the articles of association (AoA) related to leadership at the annual general meeting (AGM). With this, Tata Sons and Tata Trusts, which own 66 per cent of the group, must have separate chairmen.

Ratan Tata, who chairs the Tata Trusts, also held the position of Tata Sons chairman till 2012. The subsequent Tata Sons chairmen—Cyrus Mistry and N Chandrasekaran—have not chaired Tata Trusts, but there was no provision for a legal separation of the two positions.

Chandrasekaran has been the chairman of Tata Sons since 2017.

Noel Tata--half brother of Ratan Tata--was appointed a trustee of Sir Ratan Tata Trust in 2019 for three years. Earlier this year, he was appointed a trustee of Sir Dorabjee Tata Trust and Allied Trusts, triggering a buzz that he could get a larger role in the group and may be appointed a director at Tata Sons as well.

A Tata Sons spokesperson declined to comment.

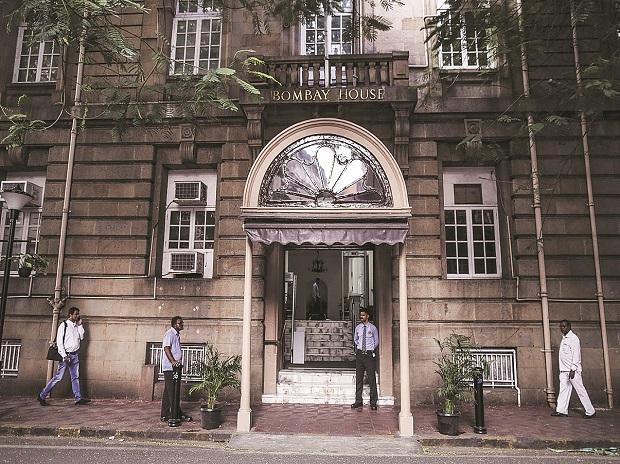

Both Ratan Tata and Chandrasekaran were present at the AGM in Mumbai.

The resolutions to renew the directorship of Ajay Piramal and Venu Srinvasan were also cleared by the shareholders. The appointment of Anita George as independent director was approved too. The Mistry family, which owns 18.5 per cent of Tata Sons, had opposed the appointment of Piramal and Srinivasan, but the resolutions were cleared, said a source close to the development.

The change in the AoA has now made it legally binding to separate the positions of Tata Trusts and Tata Sons chairmen and the move is meant for decoupling of ownership from management, a Tata group insider said. As per the new AoA, a person who is the chairman of either the Sir Dorabji Tata Trust or the Sir Ratan Tata Trust or of both, will not concurrently be eligible to be the chairman of Tata Sons.

Any alteration to the AoA of Tata Sons requires the approval of 75 per cent of shareholders present in the meeting and by passing a special resolution. The Tatas had enough support in favour of the resolution, a source said

According to the AoA, for the purpose of selecting a new chairman of Tata Sons, a selection committee will be formed to recommend the appointment of a person as the chairman of Tata Sons. The Tata Sons board may appoint the person as the chairman of the board of directors, subject to Article 121, which requires affirmative vote of all directors. The same process will now be followed for the removal of a chairman.

The selection committee will comprise three persons nominated jointly by the Sir Dorabji Tata Trust and the Sir Ratan Tata Trust who may or may not be directors of Tata Sons, one person nominated by and from amongst the board of directors of Tata Sons and one independent outside person selected by the board for this purpose, the new AoA said. The chairman of the committee will be selected by the Sir Dorabji Tata Trust and the Sir Ratan Tata Trust from amongst the nominees nominated by the Trusts.

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more