Norway Sovereign Fund Raised Ambani Bets Ahead Of Adani Group Exit

Norway’s Government Pension Fund Global, one of the world’s largest sovereign wealth funds, raised its bets on Reliance group companies even as it began to exit Adani Group stocks.

The $1.3-trillion fund announced earlier this month that it had completely exited Adani Group companies, citing concerns over environmental, social and governance (ESG) risks, among other reasons. The Adani Group had also faced allegations of stock manipulation and accounting fraud from US-based short seller Hindenburg Research, whose report has caused a Rs 12.4-trillion fall in the valuation of Adani Group companies. The group has denied any wrongdoing.

The Government Pension Fund Global had raised holdings in Mukesh Ambani group companies by $180.5 million in 2022, shows an analysis of fund documents of the latest holdings as of December 2022.

The fixed income documents showed that it had entirely sold its investment in Adani Group companies by December-end. It had holdings of $12.7 million in Adani Electricity Mumbai as of the end of 2021.

This may have been part of a larger paring down of fixed income investments in India. It reduced its holdings of government securities by $264 million. It also cut down its investment in Reliance Industries (RIL) bonds by $34.5 million to $37.8 million as of December 2022. The RIL bonds have been classified as government-related bonds. The fund said that this was due to the bonds being guaranteed by the government of India, in response to a query by Business Standard.

It declined to comment further on investment decisions in relation to the Adani or Ambani groups.

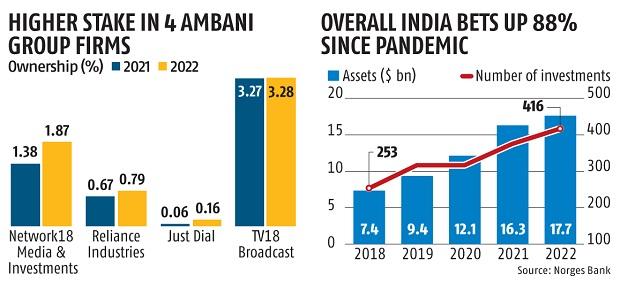

The increase in Ambani investments was not limited to RIL. The overall bets increased in at least four group companies. Their ownership stake in Network18 Media and Investments rose from 1.38 per cent at 2021-end to 1.87 per cent at 2022-end. The stake in RIL increased from 0.67 per cent to 0.79 per cent, Just Dial from 0.06 per cent to 0.16 per cent, and TV18 Broadcast from 3.27 per cent to 3.28 per cent.

The sovereign wealth fund has significantly increased its bets on Indian equities since the pandemic’s outbreak. It held 317 equity investments worth $9.4 billion at the end of 2019. The first case of Covid-19 in India was detected in January 2020. The total number of investments has risen to 416 and the value has risen nearly 87.7 per cent to $17.7 billion.

The Ambani and Adani groups did not respond to a request for comment.

The Norway sovereign wealth fund has exited a number of companies over time citing concerns over ESG risks.

“We divested from 74 companies in 2022 following assessments of ESG risks...25 of the divestment decisions involved companies that entered the fund’s benchmark index during 2022. Altogether, we have made 440 divestment decisions since 2012,” said the fund’s 2022 report on responsible investment.

The fund is designed to invest money from petroleum revenue in a way that would benefit future generations. It is now more than twice the size of the country’s economy.

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more