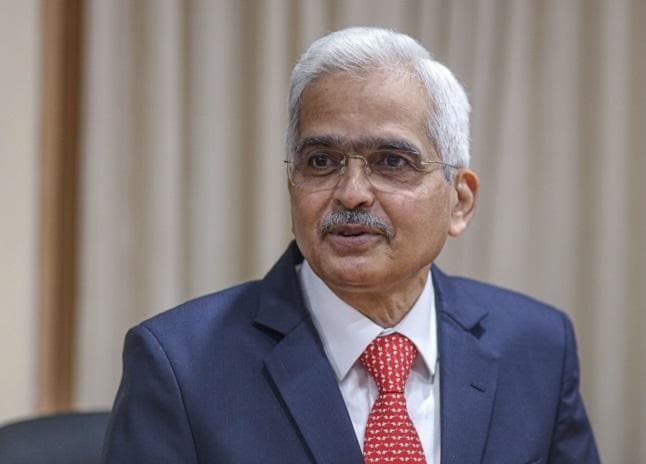

RBI Governor Shaktikanta Das (Photo: Bloomberg)

').insertAfter(".article-content__img");$(".article-content__img div").find('div').remove();

Topics

Reserve Bank | Shaktikanta Das | Gold Prices

RBI Governor Shaktikanta Das (Photo: Bloomberg)

').insertAfter(".article-content__img");$(".article-content__img div").find('div').remove();

Indian entities can hedge their exposure to gold price risk in overseas markets on recognised exchanges in the International Financial Services Centre (IFSC), Gujarat, said RBI Governor Shaktikanta Das on Wednesday.

Announcing the Monetary Policy Committee's (MPC) decision to increase the repo rate by 35 basis points, Das said: "Resident entities in India are currently not permitted to hedge their exposure to gold price risk in overseas markets."

"With a view to providing greater flexibility to these entities to hedge the price risk of their gold exposures, resident entities will now be permitted to hedge their gold price risk on recognised exchanges in the IFSC. This measure will benefit importers/exporters of gold such as jewellers and industries which use gold as an intermediate or raw material," Das said.

Welcoming the decision Colin Shah, Managing Director, Kama Jewelry said: "The RBI's approval to hedge gold at IFSC is a positive move and a major enabler for gold importers and exporters using yellow metal as the primary raw material for production. This will help increase the price competitiveness of the Indian jewellery industry."

"It will help the players hedge their positions against price fluctuations and unfavourable currency movement. This will also lead to an increase in volumes and activities at IFSC," Shah added.

--IANS

vj/dpb

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

Exclusive Stories, Curated Newsletters, 26 years of Archives, E-paper, and more!

First Published: Wed, December 07 2022. 15:41 IST

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more