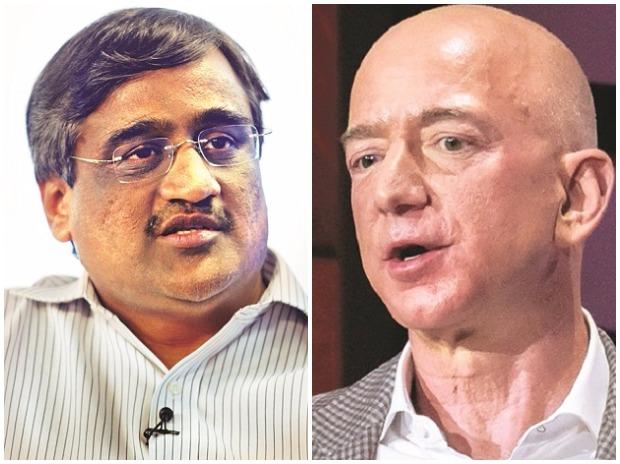

Future Retail Lawyer Likens Amazon To East India Company Over 'kill' Remark

A lawyer for Future Retail Limited (FRL) on Thursday told the Delhi High Court that Amazon is interfering with its lawful business. The lawyer argued that due to this thousands may lose jobs and FRL may go bankrupt.

The Delhi High Court is hearing Future Retail's suit related to its deal with Reliance. It was recently halted by an Emergency Arbitrator of the Singapore International Arbitration Centre (SIAC) in favour of Amazon. The arguments from the legal counsels of the companies continued on the third day. The matter was heard by Justice Mukta Gupta. The court adjourned the hearing till November 19, according to the information available on law platform Bar & Bench.

Future Retail which was represented by senior advocate Harish Salve told the court that the interference by Amazon in the Future-Reliance deal would result in thousands of job losses and FRL becoming bankrupt.

“This whole concept of minority rights being protected is nonsense. Thousands may lose jobs, FRL may go bankrupt but this great American giant (Amazon) should not be upset,” said Salve, according to Bar & Bench. “In today's day and age, to say that I will kill a 25,000 crore company. God knows if Amazon still thinks that it's living during the time of the East India Company.”

In August, Future Group struck a Rs 24,713-crore asset sale deal with Reliance Industries Ltd (RIL). Amazon then sent legal notice to Future, alleging the retailer’s deal breached an agreement with the American e-commerce giant. This was because last year, Amazon had bought a 49 per cent stake in one of Future’s unlisted firms Future Coupons Pvt Ltd (FCPL) for Rs 1,430 crore.

The matter was then arbitrated at SIAC in which Amazon got a favourable ruling last month. Future Retail's representative had told the arbitration panel in Singapore that if the deal with Reliance Retail fails, then the company would go into liquidation. The closure of the company would lead to over 29,000 job losses.

“Compare the figures invested by Amazon and what Reliance is offering. What is the amount needed to rescue FRL,” Salve told the court on Thursday, according to Bar & Bench. “Amazon says there is no agreement with Reliance yet. So what is the problem? It's the transfer to Reliance.”

Future’s legal counsel argued that the emergency order (in Singapore) has no efficacy in law and the company is entitled to ignore it.

“I am subject to Indian courts. If a gentleman sitting in Singapore says something, I can bin that order. It is not to show any disrespect. I'm saying as a matter of law,” said Salve.

He claimed that the Emergency Arbitrator was not familiar with the Indian ecosystem and fell for the 10 per cent portfolio investment, according to Bar & Bench.

Salve argued that Amazon is not even a minority shareholder in FRL, then how can there be rights conferred upon it. The lawyer contended that the company has not entered into any agreement with Amazon and it can be prevented from representing to the world that the firm needs its permission to save itself.

“Amazon is not a shareholder in FRL. How can (it) complain,” asked Salve.

Future’s legal counsel contended that as a matter of company law, only a board resolution is required for a scheme and all directors voted. There is a fiduciary duty to shareholders when FRL is sinking. It argued that for the sale of retail assets of FRL, only FCPL consent is required. It said Amazon has no rights in FRL. It argued that rights are being asserted which are way beyond shareholders rights.

“You tried your luck coming through the cracks and failed,” said Salve.

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more