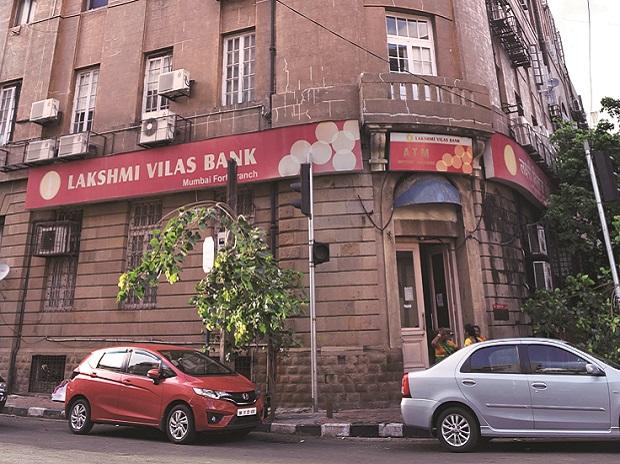

CARE Downgrades Rating For Lakshmi Vilas Bank's Issued, Proposed Securities

The 93-year old private sector Lakshmi Vilas Bank (LVB) on Friday said credit rating agency CARE Ratings has downgraded its rating of already issued and proposed securities.

In a regulatory filing, the LVB said CARE has downgraded its ratings of the Rs 50.50 crore unsecured redeemable non-convertible subordinated lower tier-II bonds to CARE BB Minus with Negative Outlook.

The rating agency has also downgraded LVB's Rs 78.10 crore, Rs 140.10 crore and Rs 100 crore unsecured redeemable non-convertible subordinated lower tier-II bonds to CARE B Minus with Negative Outlook.

The earlier ratings were CARE BB Plus with Negative Outlook.

The CARE has also revised the ratings of the LVB's proposed Rs 250 crore Basel-II compliant additional tier-I perpetual bond to CARE B Minus with Negative Outlook from CARE B Positive with Negative Outlook.

As to the rationale for the revision in ratings, CARE said it factored in the sharp decline in net worth due to significant losses reported in FY20 (the period from April 1, 2019 to March 31, 2020) and Q1FY21 (the period from April 1 to June 30) consequent to losses reported during these period.

The bank reported total capital adequacy ratio (CAR) and Tier I CAR of 0.17 per cent and -1.83 per cent respectively as on June 30.

The ratings are constrained by LVB's regional nature of operations, weak asset quality parameters, weak capitalisation levels and continuation of losses in Q1FY21.

The rating also takes note of decline in total business of the bank due to capital constraints and the recent changes in the board.

In view of current capital adequacy levels, timely mobilisation of capital to augment its CAR is critical in the near term, CARE Ratings said.

According to CARE Ratings, the negative outlook on rating reflects the likely continuation of negative net worth in view of delay in mobilising fresh capital.

The outlook may be revised to stable in the event of improvement in capitalisation levels well above regulatory requirement.

--IANS

vj/vd

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more