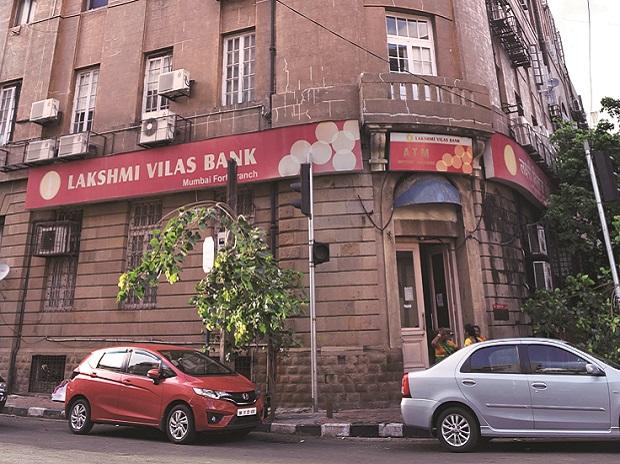

Bombay HC Denies Stay On Merger Of Lakshmi Vilas Bank, DBS Bank India

The decks have been cleared for the merger of troubled Lakshmi Vilas Bank (LVB) with DBS Bank India (DBIL) after the Bombay High Court refused to grant an interim relief (stay) to the shareholders’ petitions challenging the scheme of amalgamation by the Central government and the Reserve Bank of India (RBI).

The merger will be effective from November 27 and all branches of LVB will operate as those of DBIL from the same day.

A Division Bench of Justice Nitin Jamdar and Justice Milind Jadhav heard the petitions filed by a group of promoters of the ailing bank and Indiabulls Housing Finance Ltd.

“We are refusing the interim relief sought by the petitioners to stay the amalgamation. The petitions shall be placed for hearing on December 14, when the respondents (Reserve Bank of India, LVB and DBS Bank India) shall file their affidavits in reply,” the court said.

Those who challenged the amalgamation move include Kare Electronics & Development, Pranava Electronics, and KR Pradeep. Darius Khambata was counsel for the shareholders.

The petitioners argued the RBI’s move violated Section 45 of the Banking Regulation Act. This Section requires the RBI take consideration of all stakeholders, including the members, they contended.

RBI counsel Ravi Kadam said shareholders were risk takers. The central bank told the high court that continuity in the financial system, economy and depositor interests was important. As a regulator, its duty is on a much larger scale, it said.

On November 17, the RBI had placed LVB under a moratorium for 30 days to protect the depositors’ interests and for the sake of financial and banking stability. Also, the RBI, in consultation with the government, superseded the board of directors of LVB and appointed an administrator to run the bank.

Giving finality to the efforts towards salvaging LVB, the Union Cabinet on Wednesday gave its nod to merge LVB with DBIL. The government told the RBI to take action against those responsible for the mess at the troubled private lender and improve the oversight of entities under its regulation.

The speedy amalgamation and resolution of stress in LVB were in keeping with its commitment to a clean banking system, the government had said.

The combined balance sheet of DBIL would remain healthy even after amalgamation and its branches would increase to 600.

LVB has 563 branches and five extension counters with a pan-Indian presence. It has 974 ATMs and has deployed PoS machines at various merchant establishments.

In all, promoters have filed two petitions, one seeking a stay on the merger and another asking for some compensation if the merger should be upheld. The first petition has been rejected by the Bombay High Court, and on the second, hearing is dated for December 14.

Promoters of LVB are expecting compensation of around Rs 5,000 - 6,000 crore. The basis of this claim has been on a competitive review of other banks’ valuations namely, Tamilnad Mercantile Bank, Karur Vysya Bank and City Union Bank, which operate in the same region.

Indiabulls Housing has also filed a separate petition stating that they made an investment of Rs 199 crore for 4.99 per cent stake in the bank based on a valuation of Rs 3,200 crore. On what basis is the entire valuation is now struck down, is the contention of Indiabulls Housing. This could not be independently verified.

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more