Anil Agarwal, Centricus To Invest $10 Billion In Indian Companies

Vedanta Group Founder and Chairman Anil Agarwal, in partnership with London-based investment firm Centricus, plans to invest $10 billion in Indian companies being divested by the government.

In a joint statement on Thursday, they said they intended to invest in entities with substantial turnaround and growth opportunities.

“The launch comes at a promising time for the Indian economy and will support the government’s efforts to achieve its disinvestment targets,” said the statement, adding the strategy will allow companies to benefit from Agarwal’s experience and history of partnering with and creating value for operating businesses.

“India will be the fastest-growing large economy over the next decade. Its dynamism is based on a world-class entrepreneurial private sector, and I believe that this dynamism can be harnessed to unlock incredible transformation in the public sector. We believe that this strategy can, and will, play a crucial role in the country’s on-going industrialisation,” Agarwal was quoted in the statement.

Though Centricus’ partnership is with Agarwal, it is not clear whether it will be through Vedanta Group companies. A Vedanta spokesperson did not comment on the issue.

Agarwal plans to help former government-owned companies accelerate their transformation into private-sector firms with professional management, according to the statement.

Vedanta had recently placed a preliminary expression of interest for buying the government's stake in Bharat Petroleum Corp (BPCL). This is not the first time that Agarwal is being vocal about picking up stake in state-owned entities.

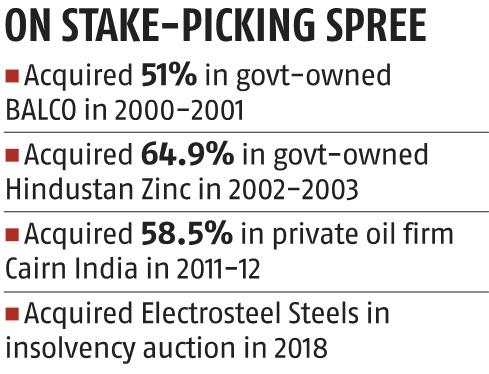

In the past, the Vedanta Group had picked up a majority stake in government-owned companies such as Hindustan Zinc and Bharat Aluminium Company.

Early this year, Agarwal had pitched for the privatisation of state-owned Hindustan Copper, stating that the only copper producer of the country needed a different dimension for growth as it had good assets.

In October, Agarwal lauded the initiative of NITI Aayog. In a tweet, he said: “Commend @NITIAayog for spearheading discussion on disinvestment of Hindustan Copper. The world is looking at this disinvestment with keen interest.”

Dalinc Ariburnu, co-founder at Centricus, said: “India’s size means that its transformation should result in significant new capital sources for newly-independent Indian companies which will support their development. We are excited to work alongside Anil Agarwal, and in partnership with management teams, to boost the competitiveness of India’s leading companies.”

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more