US Dollar, Japanese Yen, Coronavirus, S&P 500 – Asia Pacific Market Open

- US Dollar, Japanese Yen gain as coronavirus fears sent S&P 500 lower

- WHO reports new Wuhan virus cases are mostly rising outside of China

- USD/JPY near-term technical outlook bearish on key falling trend line

US Dollar, Japanese Yen Gain as Coronavirus Fears Continue Plaguing Stock Markets

As anticipated, the US Dollar started to focus on its role as the world’s reserve currency on Wednesday as sentiment cautiously deteriorated. Coronavirus fears remained front and center for the fundamental driver of equities. The S&P 500 closed -0.38% to the downside despite update local new home sales data for January. The anti-risk Japanese Yen also rose alongside the similarly-behaving Swiss Franc.

Wuhan virus cases continued to rise, with the World Health Organization reporting that most of the new outbreaks are emerging outside of China. There were a couple of cases reported in Karachi, Pakistan. Germany’s Health Minister Jens Spahn said that the country is at the beginning of a corona epidemic. Sentiment-linked crude oil prices closed at their lowest since January 2019 with the markets increasing Fed rate cut bets.

Thursday’s Asia Pacific Trading Session – S&P 500 Futures, Japanese Yen

S&P 500 futures are pointing lower in the aftermath of a press conference hosted by U.S. President Donald Trump on the coronavirus. During his speech, the U.S. Centers for Disease Control and Prevention (CDC) announced that the first domestic coronavirus case of unknown origin was reported.

A lack of critical economic event risk places the focus for foreign exchange markets on sentiment. The Yen could have further room to rally at the expense of its sentiment-linked counterparts such as the Australian Dollar. The S&P 500 is increasingly at risk to a medium-term bearish shift in the technical outlook.

Japanese Yen Technical Analysis

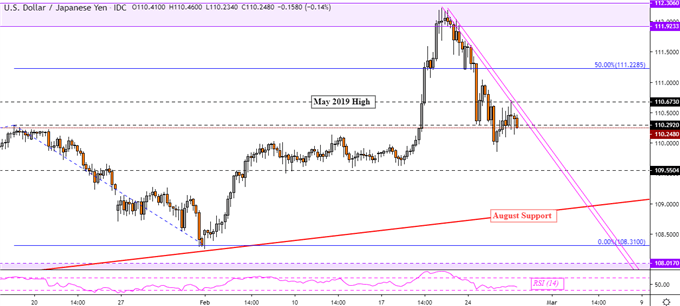

The near-term USD/JPY technical bias still seems to be pointing to the downside. Zooming in on the 4-hour chart, the pair has been in a downtrend since last week’s high. This is being maintained by falling resistance – pink lines on the chart below. If this continues holding, we may see USD/JPY eventually retest key rising support from August which if taken out, risks shifting the bias further bearish.

USD/JPY 4-Hour Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter