US Dollar, Japanese Yen, USD/JPY, Coronavirus, Fiscal Stimulus, RBA – Asia Pacific Market Open

- US Dollar and Japanese Yen sink as Dow Jones and S&P 500 soar

- Coronavirus cases appeared to stabilize, more fiscal stimulus eyed

- Australian Dollar may rise ahead but markets also eying the RBA

US Dollar and Japanese Yen Sink as Wall Street Soars and Virus Cases Seem to Stabilize

The haven-linked US Dollar and similarily-behaving Japanese Yen underperformed their major counterparts as market mood notably improved at the onset of the new week. The S&P 500 and Dow Jones closed +7.03% and +7.73% respectively, boosting the sentiment-linked Australian Dollar and New Zealand Dollar. A combination of stabilizing coronavirus cases and additional US fiscal stimulus bets likely boosted markets.

Over the weekend, COVID-19 deaths in New York State declined as new infections appeared to level off in parts of Europe. This trend continued on Monday as Spain reported new cases at their lowest in over two weeks while Italy saw the least in about three weeks. Andrew Cuomo – Governor of New York State – reported on Monday that the virus death rate was “effectively flat” for a second day.

Meanwhile local government officials hinted at further fiscal stimulus. Speaker of the House Nancy Pelosi was reported seeking at least US$1 trillion for the next bill. Senate Minority Leader Chuck Schumer said that Congress “definitely” should put forward a fourth relief bill. At today’s press conference, President Donald Trump said that he “will offer” more money for Americans in stimulus.

This is as the Federal Reserve launched its new FIMA repo facility, aimed at further lubricating global credit markets. Local funding costs appeared to stabilize, perhaps further contributing to the rosy tone on Wall Street. The British Pound weakened towards the end of the day as reports crossed the wires that UK Prime Minister Boris Johnson was admitted into a hospital for intensive care in the aftermath of contracting the coronavirus.

Tuesday’s Asia Pacific Trading Session

Asia Pacific stocks may echo the rosy tone ahead. That may bode ill for the Japanese Yen while supporting the Australian Dollar. The latter will be eyeing today’s RBA rate decision which I will be covering – see below. Cash rate futures show a near-even split on whether there may be another cut. Rates are at just 0.25%. This is an ingredient for volatility as some investors risk finding themselves on the wrong end of the outcome.

Japanese Yen Technical Analysis

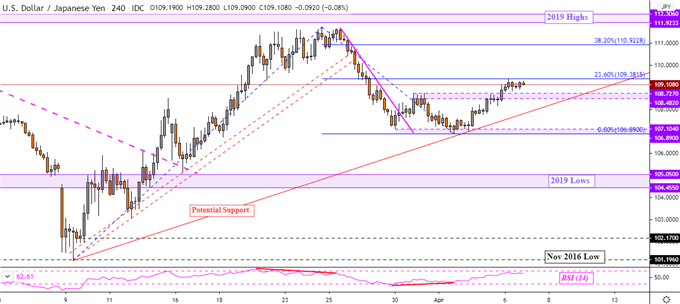

USD/JPY broke above key upper support on the 4-hour chart below. This is a range between 108.48 to 108.72. The pair faces the 23.6% Fibonacci extension at 109.38 which if taken out, exposes the 38.2% level at 110.92. Guiding the pair higher may be a rising support line from early March labeled “potential”. A third confirmation point of the trend line could further validate it. Turning lower exposes 106.89 to 107.10.

USD/JPY 4-Hour Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter