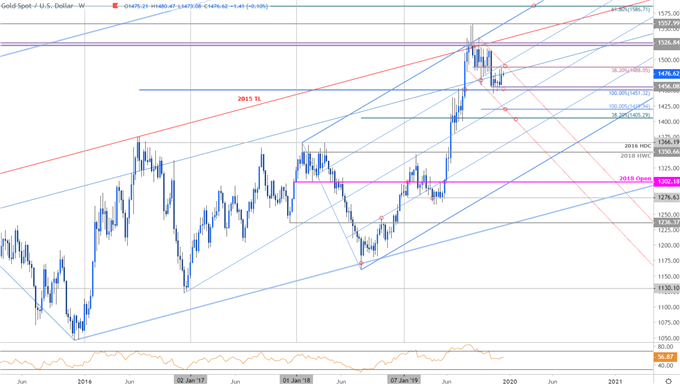

Heading into the start of 2019 our ‘bottom line’ noted to, “look for a low above parallel support next year with a breach of the descending pitchfork needed to clear the way for a larger advance in gold.” Price registered the yearly low at 1266 in April before breaching downtrend resistance with the subsequent breakout soaring nearly 23% in the following months.

A turn from confluence uptrend resistance around 1522/26 in September has the focus on the correction into the open of 2020 with the threat remaining for a larger decline towards upslope support. The 100% extension at 1420 and the 38.2% retracement at 1405 both levels of interest for possible downside exhaustion IF reached. Ultimately a topside breach above 1526 is needed to mark resumption with such a scenario exposing 1558 and the 614.8% retracement of the decline off the 2011 record high at 1586.

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex