Canadian Dollar, Crude Oil, US Dollar, Monetary Policy, Fiscal Stimulus – Asia Pacific Market Open

- Canadian Dollar sinks as crude oil swings, Wall Street closes lower

- Investors weighed Fed easing against a delay in key fiscal stimulus

- Futures hint upbeat mood next, US Dollar may see near-term losses

Canadian Dollar Sinks as Crude Oil Swings, US Dollar Mixed as Stocks Fall

The Canadian Dollar fell on Monday, responding negatively to intraday swings in sentiment-linked crude oil prices. CAD appeared to pay more attention to declines than gains in WTI as the Dow Jones and S&P 500 closed -3.04% and -2.93% to the downside in another volatile day on Wall Street. Investors weighed the implications of more aggressive Fed stimulus versus Congress being unable to pass a fiscal package.

Markets initially welcomed the Federal Reserve announcing unlimited quantitative easing. The central bank said that it will purchase bonds and mortgage-backed securities “in the amounts needed” to support a smooth functioning market. This is on top of already slashing rates to a 0.00 – 0.25% range and relaunching 2008 crisis-era tools to help boost liquidity in financial markets.

There is also much urgency in passing a fiscal package to accompany monetary policy given the limits of the latter prior to the coronavirus outbreak. A US$2 trillion relief bill was unable to gather enough votes in the Senate on Monday as lawmakers struggled to agree on the details of the measure. A delay in its passage may have been what erased gains that equities were able to pull off earlier in the Wall Street session.

The US Dollar had a mixed session, outperforming against the Canadian Dollar, Japanese Yen and British Pound. This is as UK Prime Minister Boris Johnson ordered the country’s citizens to stay home “except for essential reasons”. The Greenback continued to gain on some of its emerging market and ASEAN counterparts. Capital flight continues to pose a risk for markets in developing economies as the USD gains.

Tuesday’s Asia Pacific Trading Session – US Dollar, AUD/USD, NZD/USD, USD/CAD

A lack of key economic event risk places the focus for foreign exchange markets on sentiment during Tuesday’s Asia Pacific trading session. Futures tracking Wall Street are pointing cautiously higher, pointing to what may be a “risk-on” tilt to come. The haven-linked US Dollar is weakening with the growth-linked Australian Dollar attempting to progress higher.

US President Donald Trump mentioned that both Democrats and Republicans are “fairly close” on a stimulus bill. Democratic leader Nancy Pelosi is preparing a $2.5 trillion package. Signs of a further delay in passing a virus relief bill risks souring market mood. Otherwise the Greenback could see some weakness in the near term as AUD/USD and NZD/USD rise. USD/CAD could thus fall. The situation is highly fluid however.

Canadian Dollar Technical Analysis

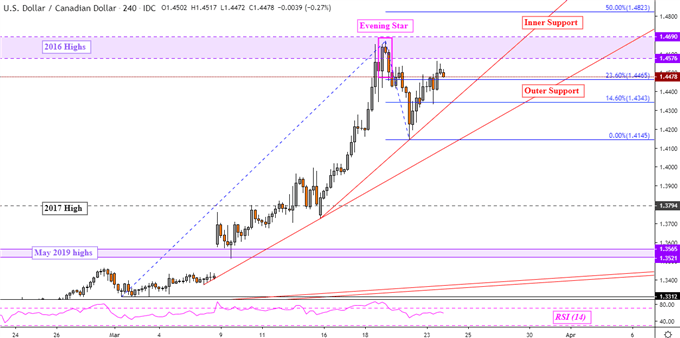

USD/CAD continues to trade sideways under highs from 2016 which make for a key range of resistance between 1.4576 to 1.4690. Yet the dominant uptrend is being supported by two levels of rising support, “inner” and “outer” on the 4-hour chart below. Taking out the former may fuel a further correction, but it may not necessarily overturn the upward trajectory.

USD/CAD 4-Hour Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter