British Pound, GBP/USD, Australian Dollar, AUD/USD – Asia Pacific Market Open

- British Pound gains as incoming BoE chief undermines rate cut bets

- Australian Dollar soars with stocks on Fed easing, “Super Tuesday”

- S&P 500 futures hint mixed session despite U.S. virus spending bill

British Pound Gains Alongside the Australian Dollar as Wall Street Rallies

The British Pound and Australian Dollar were some of the best-performing majors on Wednesday. GBP/USD received an upside boost particularly after incoming Bank of England Chief Andrew Bailey said that the central bank needs more evidence before deciding on their next move. This comes after aggressive easing from the Federal Reserve and Bank of Canada, taking preemptive measures amid the coronavirus outbreak.

Meanwhile the “pro-risk” Australian Dollar capitalized on an improvement in market mood. On Wall Street, the Dow Jones and S&P 500 closed 4.53% and 4.22% to the upside respectively. Loosening credit conditions appear to be making their way into financial markets. In fact, a closely-watched segment of the U.S. yield curve continued its aggressive rise outside of inversion territory, lowering recession fears. The anti-risk Yen fell.

On top of this, the markets may also be digesting U.S. Presidential Democratic Candidate Joe Biden pulling ahead of Bernie Sanders after “Super Tuesday”. The markets may have found the former’s policy prescriptions to present less of an uncertainty compared to the latter’s call for sweeping economic changes of an unprecedented nature. Upside momentum on Wall Street picked up pace as Biden’s campaign projected a 50-delegate lead after Super Tuesday.

Thursday’s Asia Pacific Trading Session

Heading into Thursday’s Asia Pacific trading session, the coronavirus situation remains fluid. U.S. Congress did authorize an $8b spending package to help support virus prevention measures. That may offer an upside boost to regional equities which would thus bode ill for the Japanese Yen. Yet, S&P 500 futures are pointing lower which could precede a mixed session. A lack of key data does place the emphasis for FX on equities.

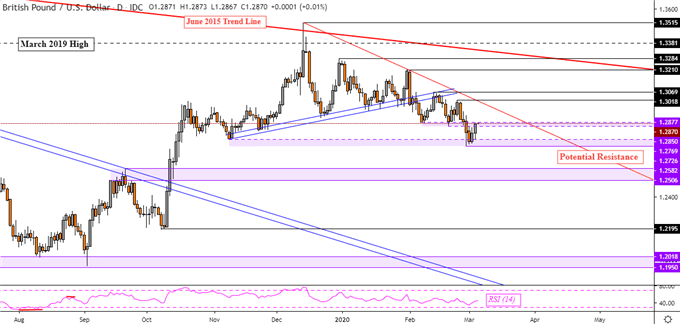

British Pound Technical Analysis

Gains in Sterling resulted in another bounce in GBP/USD as it continues abiding to the key downtrend since December. Prices are being guided lower by what may be a potential falling trend line – red line on the chart below. A push above resistance at 1.2877 opens the door to testing that trend line. Otherwise, downtrend resumption entails taking out support at 1.2726.

GBP/USD Technical Analysis

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter