Australian Dollar, AUD/USD, PBOC, US Dollar – Asia Pacific Market Open

- Australian Dollar tumbles as China easing disappointed expectations

- Stocks fell, boosting the haven-linked US Dollar throughout the day

- AUD/USD outlook may become further bearish on key support break

Australian Dollar and New Zealand Dollar Sink in “Risk-off” Trade as US Dollar Gains

The “pro-risk” Australian Dollar and similarly-behaving New Zealand Dollar were some of the worst-performing major currencies on Thursday. Sentiment markedly deteriorated, beginning during the Asia Pacific trading session. There, China failed to impress financial markets with cuts to the prime rate on one-year and 5-year loans. The Nikkei 225 gave up most of its upside gap, closing 0.34% to the upside.

Market pessimism then permeated throughout the European and North American trading sessions, boosting the haven-linked US Dollar. There was some sideways price action on Wall Street. The Federal Reserve accepted a grand total of $65.25b in repurchase operations, offering liquidity which helped to slow the descent in equities. A swelling in its balance sheet is generally a bullish outlook for sentiment.

Anti-fiat gold prices extended their rise as U.S. front-end government bond yields declined. Fed funds futures are now fully pricing in 1 cut this year with odds of a second one at around 70%. The anti-risk Swiss Franc outperformed while puzzlingly the often similarly-behaving Japanese Yen fell short of expectations. Newswires have been attributing declines in JPY as a result of concerns that Japan may enter a recession.

Friday’s Asia Pacific Trading Session – Australian Dollar, AUD/USD

S&P 500 futures are pointing lower heading into the end of the week, perhaps hinting of a “risk-off” tilt to come during the APAC session. That may continue depressing the Australian Dollar with the US Dollar poised to capitalize during times of market stress. Japanese manufacturing PMI and all industry activity may be closely scrutinized for signs of economic weakness.

Australian Dollar Technical Analysis

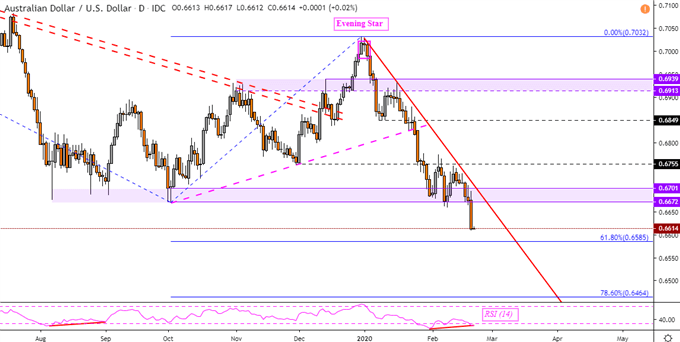

AUD/USD has taken out the critical support range between 0.6672 to 0.6701, a boundary that has kept declines at bay since August. That risks shifting the Australian Dollar technical outlook deeper into bearish territory. Do note that there is the presence of positive RSI divergence, showing fading downside momentum which can at times precede a turn higher. A further close lower would help confirm the breakout.

AUD/USD Daily Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter