Aussie Price Outlook Talking Points:

- AUD/USD set a fresh 10-year-low in the month of August.

- A bullish bounce developed in early-September with prices quickly running to resistance. That resistance held through the FOMC rate decision and bears have made a return, threatening to re-test those August lows.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Aussie Technical Outlook: Bearish

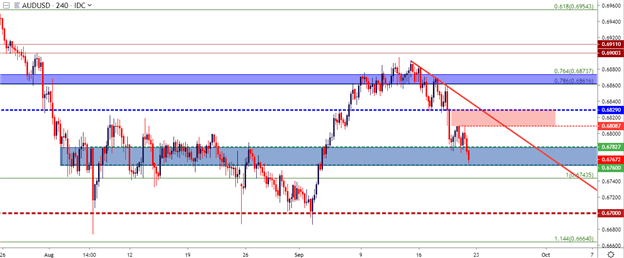

This week saw sellers return in the Australian Dollar after the early-September bounce ran into resistance. I had looked at a zone of resistance in AUD/USD during the Tuesday webinar that spanned from .6862-.6873. That resistance held through the FOMC rate decision and as US Dollar strength began to creep-in to the equation in the latter portion of this week, AUD/USD fell down to the first targeted area, running from .6760-.6783. This puts the pair in position to re-test those fresh decade lows that were set in early-August around the .6700 handle before a couple of higher-lows developed later in the month.

AUD/USD Four-Hour Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

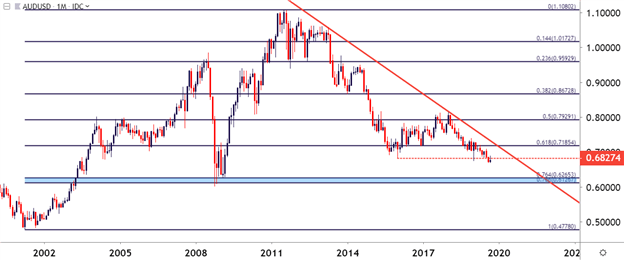

Taking a step back on the AUD/USD chart, and there is scope for continued downside. The bigger-picture bearish bias that’s been in-play on the Aussie since early-2018 ran into a wall in early-August after price action touched down to fresh ten-year-lows around the .6700 handle, and that led to the early-September bounce which is now in question. On a longer-term basis, bigger-picture support potential remains around the .6250 area on the chart, which is the same zone that helped to hold the lows in the pair around the Financial Collapse in 2008 into early-2009.

AUD/USD Monthly Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

Aussie Technical Forecast for Next Week: Bearish

For next week, the forecast on the Australian Dollar will be set to bearish, looking for a continuation of this week’s sell-off to press down towards August lows. From a strategy perspective, should a short-term retracement develop after next week’s open, lower-high resistance potential could be sought out around a zone of prior support/resistance that runs from .6808-.6829. The bearish theme could then target a re-test of the prior 2019 flash crash low around .6744, followed by the .6700 handle. At that point, stops can go to break-even as traders look for a short-side breakout on the remaining pieces of the lot.

AUD/USD Four-Hour Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX