An assembly line worker works on the production line at Midwest Automotive Designs in Bristol, Indiana, April 16, 2019.

Tim Aeppel | Reuters

The U.S. economy is expected to have grown in the second quarter at the slowest pace in more than two years, but the data will have little bearing on the Fed when it holds its rates meeting next week.

The data could provide a clear picture of the dichotomy in the U.S. economy, where manufacturing and business data has been hit by trade and slipping global growth while U.S. consumers have been more resilient.

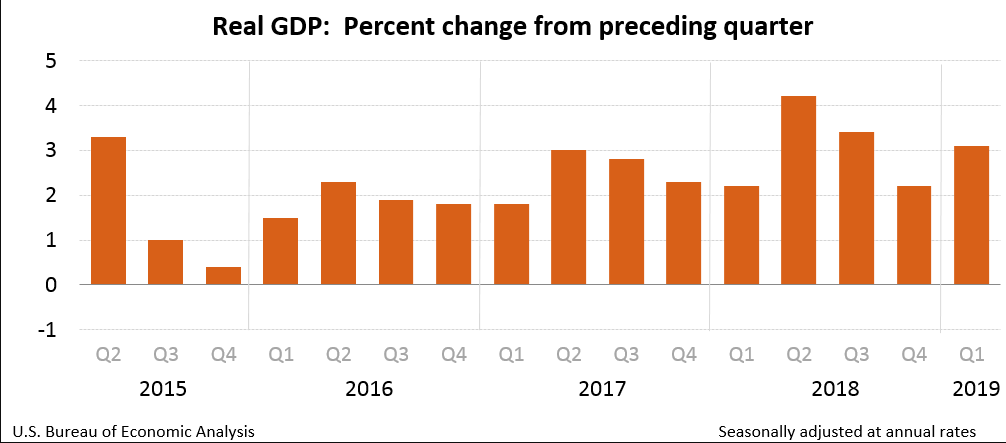

GDP for the quarter ended June 30 is scheduled to be released at 8:30 a.m. ET Friday, and is expected to come in at 1.8%, according to economists surveyed in CNBC/Moody's Analytics Rapid Update. Economists surveyed by Refinitiv also expect 1.8% growth, but the Dow Jones consensus forecast is 2%.

"It should be under 2%," said Joseph LaVorgna, chief economist Americas at Natixis. "Housing looks weak. Inventories look weak, capex, I don't think is going to be strong. ... That should be partially offset by consumer spending being solid."

LaVorgna said when averaged with 3.1% growth in the first quarter, growth remains at a healthy pace above 2%.

"The Fed is going to be cutting almost regardless because they boxed themselves into a corner," said LaVorgna.

The data is being watched as the last big piece of the economic puzzle available to the Fed before it meets Tuesday.

The GDP data could also be one of the softer economic reports recently, since it is second quarter data and some of the latest third quarter data has been coming in better than expected, including employment data and retail sales.

"The market will respond if you get a number that's very different from what consensus is. It's less important now than it was because the Fed is less data dependent now," said Hans Mikklesen, Bank of America Merrill Lynch credit strategist. "I think they should be more data dependent, but they are locked into the rate cut ... I think the market gets it right that the Fed is really looking at inflation. They're afraid they're losing the battle to reverse inflation expectations."

The Fed's favored inflation measure, the personal consumption expenditures price index is released as part of the GDP report. Last quarter, the core PCE price index was up just 1.2% quarter over quarter, well below the Fed's 2% inflation target.

Fed Chair Jerome Powell has said the Fed would take action if needed, based on its monitoring of global economic weakness, the impact of the trade wars, and soft inflation readings. Powell has also said the Fed could act, as appropriate, to extend the U.S. economic expansion.

Market expectations are broadly for a 25 basis point rate cut, unless for some reason the GDP data is shockingly weak. If it is, the market could then push on the idea of a more potent 50 basis point cut that would have more power to jolt the economy.

Strategists said the fact the European Central Bank did not ease or give more details of its plans earlier Thursday disappointed markets, but also reinforced the view the Fed may not need to be too aggressive. The ECB is still expected to cut rates and discuss more quantitative easing, or asset purchases, at its September meeting.

"Look at the big picture you had the [bond] market rallying yesterday and you had rates coming down because of weak German PMI data. That ignited expectations that the ECB was going to do more today," said Mikkelsen.

The strategist said spreads were already tightening based on prior signals from the ECB which began leaning toward easing at its last meeting.