Stock futures, higher before the reports, reversed course after the two 8:30 a.m. reports. The Dow was down more than 220 points in early trading, but stocks cut their deepest losses in morning trading. The bond market convulsed, with the 10-year yield retreating from an early of 2.71 percent to 2.64 percent, after the number.

"It's obviously creating recession fears, but the dirt is always in the details, and the details are not as bad as the headline number. These markets have been complacent lately," said Swonk. "It's amazing what a hair trigger they've been on, to go in either direction. That underscores the idea that there's uncertainty about the year ahead, which is mostly political and trade related, and geopolitical. It's basically like walking on egg shells."

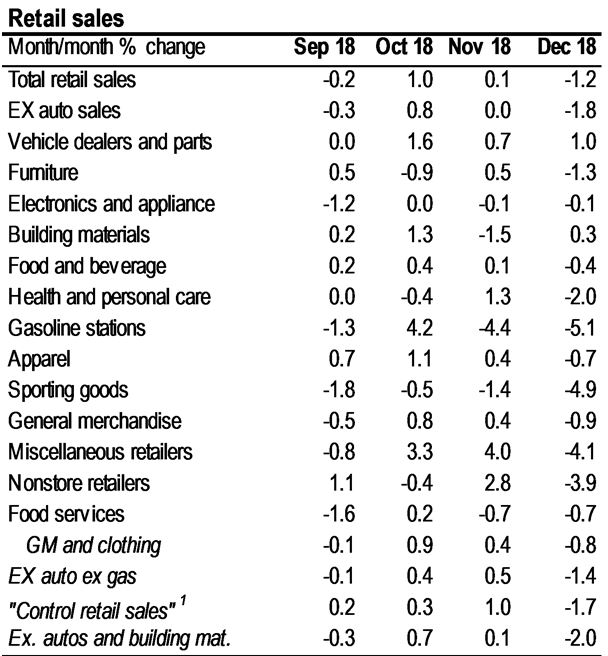

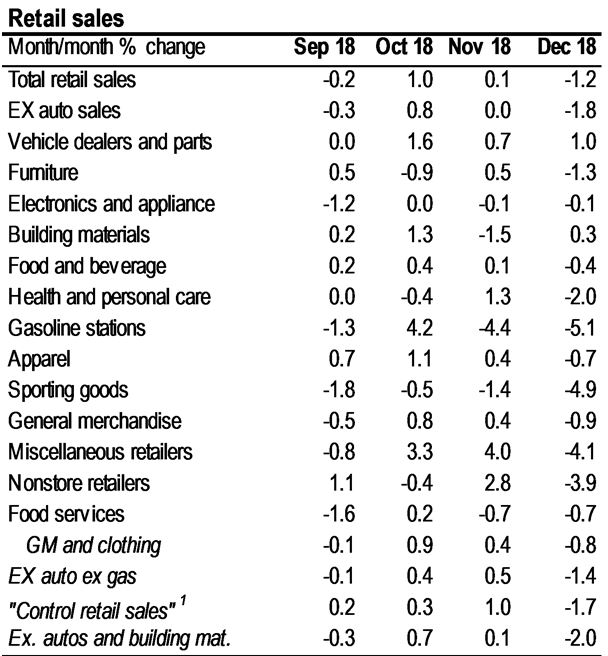

Consumer confidence fell in both December and January, and the January decline was blamed on the temporary effect of the government shutdown. But that does not explain December's abrupt retails sales drop.

"Part of the problem is the government shutdown. We had a data void, and now we're getting data in that was lagged. Everyone was euphoric that December was a good month, for big box retailers. Traditional retailers not as much," Swonk said. She said the data showed softness in leisure, yet restaurant hiring was strong, "That was a surprise given what we've seen in food service."

Economists said the weakness in December sales data will feed through into the first quarter and give it a lower starting point.

"The bottom line on this data release is that it is truly dreadful pretty much across the board. Taken literally, this data release would indicate that the consumer sector collapsed in December. This release is such an outlier and so incongruous with the general trend in consumer spending, holiday consumer sales reports and holiday seasons consumer credit data that it does raise suspicions of data reliability," wrote Ward McCarthy, chief financial economist at Jefferies.

McCarthy said the government appeared to dismiss the issue in its statement, by noting that the data collection was delayed due to the shut down but that "processing and data quality were monitored throughout and response rates were at or above normal levels for this release."

"In the context of the government shutdown and delayed data collection, we still think that some suspicion is warranted," he noted.

*1 excludes gasoline, automotive dealers, building materials and food

Source: Census Bureau, JP Morgan