Mortgage rates fell quickly after the Fed's announcement Wednesday that it would be getting back into the bond-buying business, big time – which could take rates even lower.

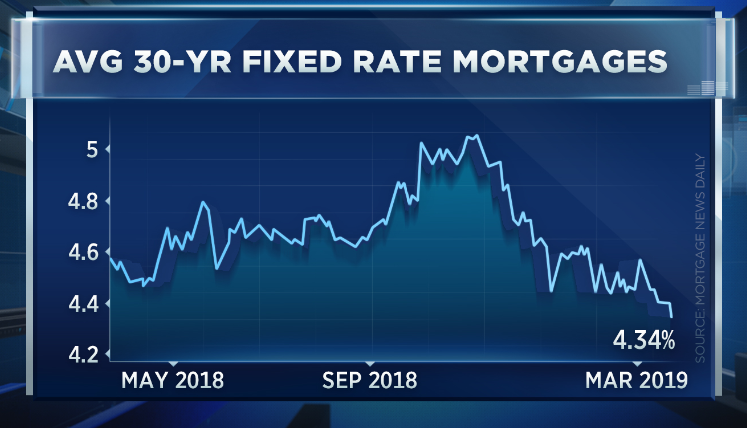

The average rate on the popular 30-year fixed, which had been sitting for days at 4.40 percent, fell sharply to 4.34 percent, according to Mortgage News Daily. That is the lowest in over a year and 19 basis points lower than a year ago. The rate had surged to over 5 percent at the start of November, which caused home sales to fall sharply in December and January.

The move in mortgage rates followed Fed Chairman Jerome Powell's announcement that the central bank would end the so-called runoff of bonds from its balance sheet sooner than most expected. That caused the yield on the 10-year Treasury to tumble. Mortgage rates loosely follow that yield.

"This is about as big of a change as anyone expected. It means the Fed will be buying more bonds more quickly," wrote Matthew Graham, chief operating officer of Mortgage News Daily. "And bond buying results in lower rates, all other things being equal."